A For Sale sign is posted in front of a home for sale in San Marino, California on September 6, 2023. Getting a mortgage in October will be for only the most diehard home buyers, as rates are likely to inch upward to their highest levels since 2000. Intrepid home shoppers might discover that more sellers are reducing their asking prices, but buyers will continue to struggle to find places they can afford. (Photo by FREDERIC J. BROWN/AFP via Getty Images)

By Holden Lewis | NerdWallet

October mortgage rates forecast

Die-hard home buyers, driven by life circumstances, will press forward in October. Everyone else will be inclined to wait for mortgage rates to fall, making homes more affordable. They’ll have to bide their time for months, not for weeks. In September, mortgage rates reached their highest levels since 2000, and they could inch upward in October.

Intrepid home shoppers might discover that more sellers are reducing their asking prices, but most would-be buyers will struggle to find suitable places to make offers on.

Rates rose after the Fed meeting

The Federal Reserve’s monetary policy committee met Sept. 19 and 20. Its updated summary of economic projections included Fed members’ forecasts about the direction of short-term interest rates for the next three-plus years. Mortgage rates didn’t move much in the three weeks before the Fed meeting as the market waited for the summary of economic projections to drop.

The projections surprised the mortgage market. The Fed members signaled that they expect to keep short-term interest rates higher for longer than the mortgage market had expected. Mortgage rates played catch-up after the Fed meeting, with the 30-year fixed-rate home loan rising past 7.25% for the first time since late 2000.

Home affordability fades

Rising mortgage rates chip away at home affordability, which has been declining since early 2021. The Federal Reserve Bank of Atlanta has a home affordability index with data going back to the beginning of 2006, and July’s affordability (the most recent available) was the lowest in the index’s 17-year-plus history. And mortgage rates have gone up since July, making a home even harder to afford.

Mortgage rates have gone up five months in a row, making mortgage payments higher for a given loan amount. The impact on affordability has motivated almost 40% of home sellers to reduce their initial asking prices, according to Mike Simonsen, president of real estate analytics firm Altos Research, in a weekly commentary posted to YouTube. In spring, when mortgage rates were lower, about 30% of the homes on the market had taken a price cut.

Home buyers might rejoice at the news that more sellers are reducing their asking prices. But the lack of properties to choose from remains a drag. According to the National Association of Realtors, 1.1 million homes were for sale at the end of August, the latest available data. In August 2019, a closer-to-normal, pre-pandemic market, 1.83 million homes were for sale.

What other forecasters predict

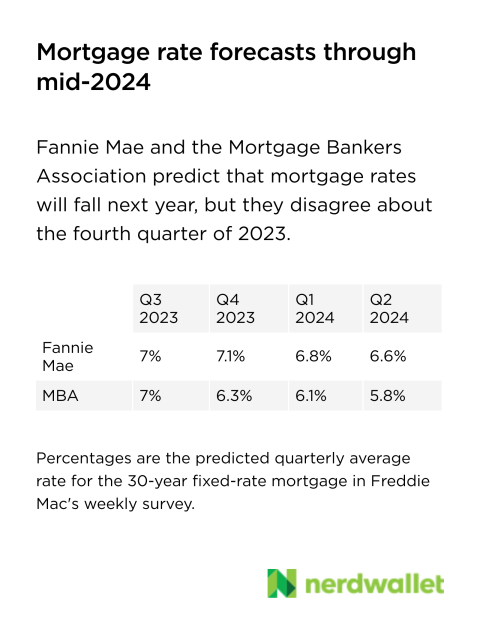

Fannie Mae and the Mortgage Bankers Association disagree in their mortgage rate forecasts for the last three months of the year. Fannie Mae predicts a slight increase at year end, while the MBA expects a sharp decline foreshadowing a recession in the first half of 2024. Both organizations published their forecasts before the Sept. 19-20 Fed meeting that hinted at a sustained level of higher interest rates.

What happened to mortgage rates in September

At the end of August, I predicted that mortgage rates might rise in September because of uncertainty about what the Federal Reserve will do.

Indeed, mortgage rates rose after the Sept. 20 Fed announcement. Freddie Mac reported that the average rate on a 30-year mortgage climbed to 7.31% in the week of Sept. 28, the highest since the week of Dec. 15, 2000.

The article October Mortgage Rates Forecast: Highest in 2 Decades originally appeared on NerdWallet.

Originally published at NerdWallet